Introduction

In 2018, Reward Gateway's Holiday Trading product went through an overhaul in order to make buying and selling annual leave easier for employees as well as HR and payroll teams.

Here are the features our clients can use within Holiday Trading:

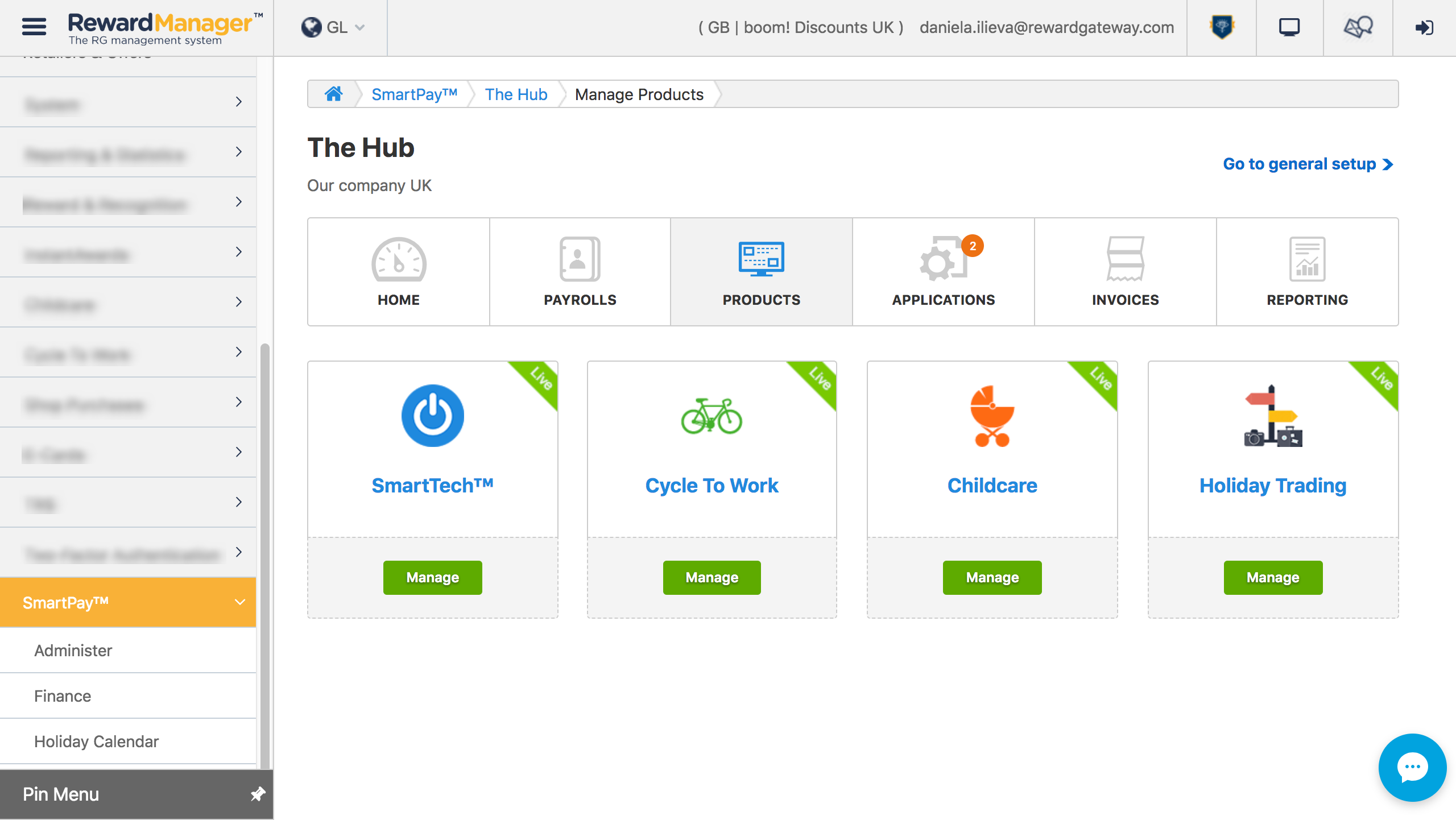

Holiday Trading is part of our SmartPay platform, which makes the administration of salary sacrifice and payroll deduction benefits quicker and simpler.

For example, if a client has more than one salary sacrifice product (e.g. SmartTech™, Cycle to Work, Childcare Vouchers) with Reward Gateway, they will be able to manage them all easily from one place (image below).

Payroll and deduction management

Clients can organise their workforces into payrolls easily by creating different payrolls within the system. It takes less than a minute to create a payroll.

Another helpful feature in SmartPay™ is ‘payroll colour’, which is used for the client's personalised payroll calendar, which marks the important dates of all payrolls. See how it looks below:

SmartPay™ provides all of the information needed to make salary deductions via deduction reports.

This information can be downloaded directly from the Payroll tab.

Deduction report details include:

- employee name;

- benefits used;

- total deduction amount;

- the current deduction; and

- how much is left to pay off.

For more information on deduction reports, see SmartPay™ deduction reports.

Managing applications

SmartPay™ enables clients who have more than one salary sacrifice or payroll deduction product with us to manage all applications from one place. For more information, see How to manage applications in SmartPay™ .

Holiday Trading features an easy to use, automated pre-approval process for employee applications. If a client uploads salary data for their employees, when they set maximum/minimum limits (e.g. how many days/hours they’d like to allow their employees to buy/sell) the product will automatically process all applications submitted by their people, based on the data the client provided in advance. The system will take into account the set limits, and will also check if the employee will go below national minimum wage, or if they are under 18 years old.

In other words, if a client has 4,000 employees, this automated process can save them about 24 hours a year!

If the client prefers to manually review and approve/reject the applications, then Holiday Trading can also be run on a post-approval basis. If using post-approval, only the Holiday Trading rate is required (not salary), however, in this case, the client will not be able to benefit from the automatic checks the pre-approval provides.

*Please note that if a client uses another gross salary product on pre-approval and they want Holiday Trading on post-approval, they’ll still need to provide salary information.

Scheduling windows

Clients can use the window scheduler to create windows not only for the Holiday Trading product but for all salary sacrifice products they use by simply dragging and dropping the product icon on the timeline.

Setting employees' application limits

Clients can set up the maximum number of days/hours to buy/sell (e.g. employees' allowance) for all employees. They can also select a minimum buy/sell amount per application in order to simplify deductions.

If they want to change the allowance for a specific employee or a group of employees, clients can simply upload the allowance for this person/s and the changes will apply only for them.

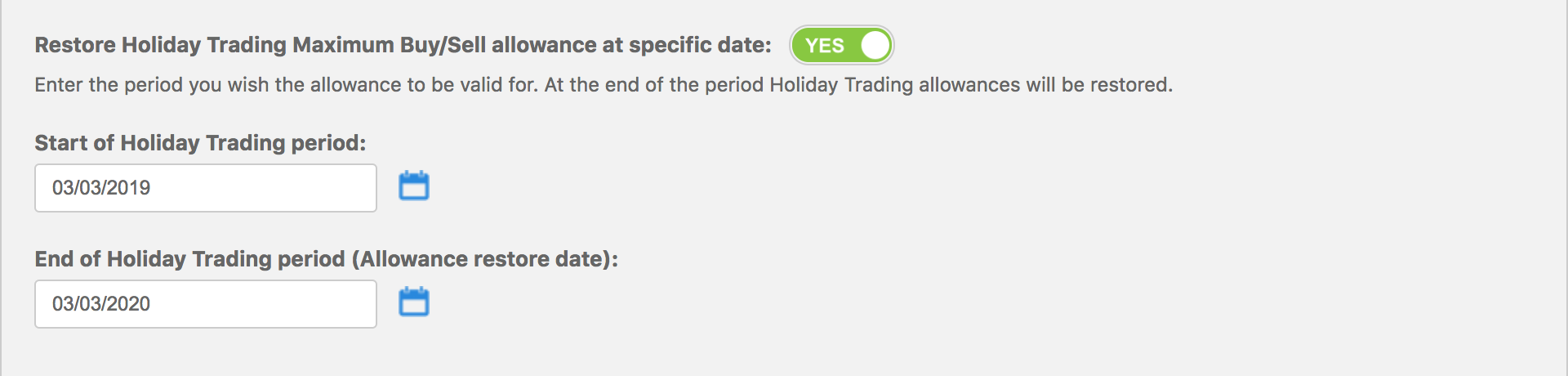

We have the option to refresh the allowance on a specific date by defining the start and end of the Holiday Trading period.

- How it works: Let's say that an employee has a Holiday Trading allowance of 5 days. If the client sets a date for End of Holiday Trading period, the full allowance will be restored to 5 days on that date regardless of how many days were used before that. (see how the setting looks like in the product configuration below)

Managing repayment periods

Managing repayment periods

Clients can choose between fixed or dynamic repayment period for their employees if they use the pre-approval process of the product.

- Fixed repayment period - when an employee submits an application, they need to pay it off in a specific time frame. For example, if a client chooses fixed repayment period of 2 months, then their employees will need to always repay their applications for the upcoming 2 months after they’ve submitted their application.

-

Dynamic repayment period - when an employee submits an application, they need to pay it off by the date the client selected for all their employees, no matter if employees apply 5 months or 5 days before this date (the date the client set up for all).

For more information, see What are the repayment periods and what options are there?.

Reporting

On-screen, real-time statistics are available from the reporting tab, so clients can see:

- the total spending amount graphic for all salary sacrifice products they use

- average basket value of transactions

- number of transactions

- savings value

- total number of employees

In addition to that, they also have the following Holiday Trading specific reports at hand:

- Export all Variations of Contracts

- Pending approvals per Line Manager

- Users eligible for Holiday Trading

Comments

0 comments

Please sign in to leave a comment.